Nvidia’s Record $39.3 Billion Q1, Synopsys Q1 and Blackwell, Plus Chips Act Funding

Everyone following the markets was watching Nvidia’s results this week, especially since it is the stock that drives sentiment in the tech stock indices at the moment. Well, the company announced a record for its fourth quarter that ended Jan. 26 of $39.3 billion, up 12% from the previous quarter and up 78% from a year ago. For fiscal 2025, revenue was $130.5 billion, up 114% from a year ago.

“We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries,” Jensen Huang, founder and CEO of Nvidia, said in prepared remarks.

It seems Blackwell is selling well. In her commentary, Nvidia CFO Colette Kress said that data center revenue for fiscal 2025 was $115.2 billion, up 142% from a year ago, and for the fourth quarter, data center revenue hit a record, up 93% from a year ago and up 16% sequentially. This was driven by demand for accelerated computing used for LLMs, recommendation engines and generative AI applications.

“We delivered $11.0 billion of Blackwell architecture revenue in the fourth quarter of fiscal 2025, the fastest product ramp in our company’s history. Blackwell sales were led by large cloud service providers, which represented approximately 50% of our data center revenue,” she said. “Data center compute revenue was $32.6 billion, up 116% from a year ago and up 18% sequentially, driven by demand for our Blackwell computing platform and sequential growth from our H200 offering.”

She added that networking revenue was $3.0 billion, down 9% from a year ago and down 3% sequentially.

“We are transitioning from small NVLink 8 with Infiniband to large NVLink 72 with Spectrum X. Networking experienced growth in Ethernet for AI, which includes Spectrum X end-to-end Ethernet platform, and NVLink products related to the ramp of our Grace Blackwell platform,” she said.

Synopsys posts $1.511 billion Q1 results

Synopsys reported results for its first quarter of fiscal year 2025 with revenue of $1.455 billion, compared to $1.511 billion for the same quarter in 2024. Indicating the latest quarterly figures exceeded midpoint guidance, Sassine Ghazi, president and CEO of Synopsys, said in prepared remakrs, “We are continuing to see strong design activity at advanced nodes, fueled by the AI-driven reinvention of compute. As the pace and complexity of technology innovation increases, new silicon-to-systems design paradigms are essential, and Synopsys is well-positioned to deliver.”

The company reports revenue and operating income in two segments: design automation and design IP. For the quarter ending on Jan. 31, design automation revenue represented around 70%, at $1.020 billion, while design IP generated the remaining 30% at $435 million. This compares to 65% and 35% respectively for design automation and design IP for the same quarter ending Jan. 31, 2024.

Design automation covers advanced silicon design, verification products and services, system integration products and services, digital, custom and field programmable gate array IC design software, verification software and hardware products, manufacturing software products. Meanwhile, design IP includes interface, foundation, security, and embedded processor IP, IP subsystems, and IP implementation services.

“These results are a product of our resilient business model, strong operational execution, and leading technology that is mission-critical to customers. We are reaffirming our full-year guidance including expectations for double-digit revenue growth,” said Shelagh Glaser, CFO of Synopsys, in prepared remarks.

Ams OSRAM gets €227 European Chips Act money for optoelectronic sensors facility

Ams OSRAM announced that the European Commission has approved funding of up to €227 million (about $235 million) under the European Chips Act for a semiconductor manufacturing facility to expand its clean room facility at its Premstaetten, Austria, site, with an area of 1,800 square meters. With this funding, the total planned investment in the site by the time full production begins in 2030 will be €567 million (about $587 million).

The new plant will produce next-generation optoelectronic sensors qualified for applications in medical technology and the automotive industry. The company said the production of products for industry or for use in consumer goods is also planned. It expects to combine CMOS, filter and through-silicon via technologies, as well as adopt a toolbox concept.

The latter means that depending on the product, different capabilities can be combined individually as required for energy-efficient products for imaging and optoelectronics with a reduced form factor, more functions on a single component and outstanding electrical performance.

Speaking about the investment, Aldo Kamper, CEO of ams OSRAM, said, “The financing is part of ams OSRAM’s important investments in Austria in new generations of innovative microchips for medical and automotive applications. The first fab of its kind for next-generation optoelectronic sensors is a key cornerstone of our growth strategy. In line with the objectives set out in the European Chips Act, it will strengthen Europe’s security of supply and technological autonomy in the field of semiconductor technologies. We are grateful for the support we have received from both the Austrian government and the European Commission.”

Infineon and Eatron extend collaboration for AI battery management

Infineon Technologies and Eatron announced they are extending their existing partnership for battery management solutions (BMS) in automotive to a deliver a BMS portfolio for various industrial and consumer applications.

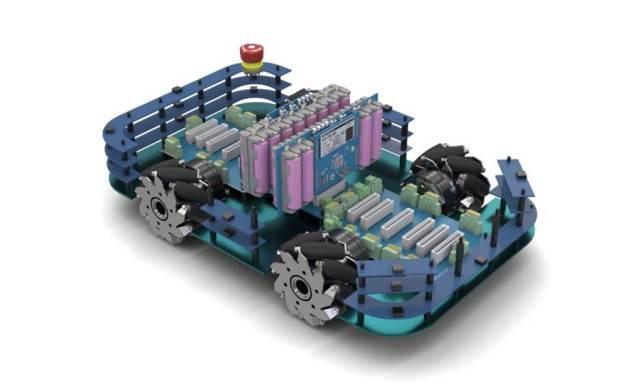

The technology integrates Eatron’s AI-powered BMS software, based on pre-trained models, featuring state of charge, state of health, remaining useful life and safety diagnostic, with Infineon’s components including MOSFETs for battery protection and PSOC 6 AI-based battery management system for state-of-the-art ML capabilities. This enables customers to unlock a range of benefits, including accurate predictions of state-of-charge of batteries. The partnership addresses the growing demand for advanced battery management systems in industrial and consumer markets, such as light EVs, portable electronics, energy storage systems, robotics and power tools.

Eatron’s software has been pre-validated and deployed on Infineon’s PSOC. It has been benchmarked on an application comprising up to 24 cells, against traditional techniques that require extensive cell characterization. The evaluation was conducted using a commercially available LG Chem INR21700 M50 cell across a broad temperature range (0–45 degrees Celsius), demonstrating comparable results.

The technology integrates Eatron’s AI-powered BMS software with Infineon’s components, including MOSFETs for battery protection and PSOC 6 AI-based battery management system for state-of-the-art ML capabilities. (Source: Infineon)

The technology integrates Eatron’s AI-powered BMS software with Infineon’s components, including MOSFETs for battery protection and PSOC 6 AI-based battery management system for state-of-the-art ML capabilities. (Source: Infineon)

Sign up to our newsletter

Receive our latest updates about our products & promotions